Table of Content

Home healthcare professionals who offer medical care will pay more for insurance than non-medical caregivers. If a Home Care caregiver fails to recognize critical changes in the patient’s condition or general health, the result might be a medical crisis, adverse outcome or even a fatality for which the Home Care agency is held liable. The Professional Health Care Liability policy will cover such claims. The key words are bodily injury and property damage, defend and legally obligated. You may add additional insured to your group liability policy at anytime. This can be done during the application process, as well as throughout the lifetime of the policy.

We are working in partnership with Amwins Program Underwriters to create insurance program unique to Home Health Care services. I can't say enough good things about Daniel Santos kind and effective communication skills as an insurance agent. Daniel was so pleasant, friendly and efficient with helping me obtain insurance as a teacher. He made the process easy to understand, it was far easier than what I anticipated.

Cyber liability insurance

Several issues can occur when working in a patient’s home that would warrant the need for liability insurance. This policy can pay legal costs related to work performance, such as an accusation of negligence from a client's family member. He explained everything in a very clear/logical way and answered all of my questions. After providing all the information to obtain general liability insurance, Jose sent me the declaration page of the insurance for review. All of the information matched what I provided over the phone and there were no typos.

For example a roofer working on a roof faces much higher risks than an accountant sitting in an office behind a desk. Depending on the wording of the policy, this type of insurance may cover the defense and settlement of a whistleblower lawsuit. If the liability insurance policy is broad enough, it might cover acts as diverse as libel, slander and sexual harassment. The allegation will be that the HHA failed to act the way that a reasonable HHA would act under the same or similar circumstances, and that such failure resulted in the bad outcome. Defend – If the patient or consumer sues the Home Care agency for the negligence of its employed caregiver then the General Liability policy will provide an attorney and defend you in the lawsuit.

Necessary Insurance for Home Health Agencies

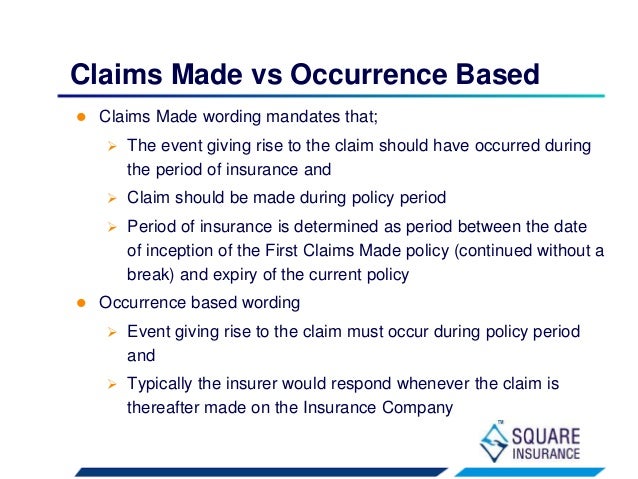

Bodily injury – In the case of Home Care, when a caregiver is transferring a patient, and he or she is hurt due to a fall, the General Liability policy will pay for patient’s related medical bills suffered by the patient or consumer. However, home care agencies are not without their risks, and these are the three types of home health care liabilities to prepare for this year. You are only able to report a claim on a claims made policy while the policy is active. Have peace of mind knowing your business is protected with CM&F’s top-rated, reliable home health agency malpractice insurance. A personal care aide or companion caregiver will likely have lower premiums than a registered nurse or home healthcare provider who also manage their clients' medical care.

The agent that I spoke to was very experienced and could tell that I was new at this and was very understanding and took the time to explain everything to me. BizInsure offers Miscellaneous Medical Liability Package designed specifically for Home Health Care Professionals. The package includes General Liability, Professional Liability, and Cyber Liability insurance.

Welcome to Harter Hill Insurance Agency LLC

Construction ContractorsLearn about New York construction contractors insurance, including how much the premium costs and what is covered - and how commercial insurance can help protect your NY construction business from lawsuits. AgribusinessLearn about NY agribusiness insurance - a type of commercial insurance protects farmers against loss of, or damage to crops or livestock. Get the best NY small business insurance quotes online & info on cost, coverage, minimum requirements, certificates & more. Post-Payment Audits—Like other health care providers, HHAs are targets of post-payment audits.

Like most other business, your Home Health Business probably uses a computer system to keep track of your client’s details, services, and employees. We offer all types of Personal Insurance coverages to our clients in New York including Auto Insurance, Homeowners Insurance, Boat & Watercraft, Flood Insurance, and Individual Disability. The commercial insurance content available on this page is for informational purposes only and not for the purpose of providing legal or financial advice. If you are thinking about doing business in the Empire State, one of the best industries to consider is finance. It is predicted that this sector will contribute largely to the economy in 2022, as well as in the coming years. Healthcare services and education are also expected to see growth, as are the transportation industry, and professional and business services.

Workers Comp

Back injuries are common due to the mobility limitations of many home healthcare patients who require lifting or support. Unruly or unpredictable patients can cause injury or harm including strains, back injuries and contusions. The employee must be able to handle conflicts that may occur during interactions with other family members.

Without home health care insurance coverage, you would be responsible for paying legal fees resulting from a liability claim from your own pocket. This could be financially devastating to your business, particularly if you are ordered to pay a hefty judgement by the court. Worst-case scenarios could mean filing for bankruptcy, closing your business, or borrowing from your personal savings to pay these expenses. Locally owned and operated, Affiliated Agency Inc. has delivered quality insurance solutions to individuals in New York, specializing in Business, Home and Auto insurance coverage. Our team of experienced insurance professionals is committed to helping you find a policy that fits your needs.

But before you can begin helping the ailing, you need the right legal protections in place for the day something goes awry. We handle business insurance for healthcare staffing agencies in order to help make the process quick and painless. Small BusinessProtect your company and employees with NY commercial insurance. Read informative articles on New York small business insurance coverages - and how they can help shield your company from legal liabilities. Depending on the incident in question and whether it could be linked to negligence on the employee’s part, the agency could find itself in hot water without the proper professional liability or errors and omissions coverage.

The business income and extra expense exposure can be minimized if the agency has arranged for temporary facilities with another healthcare agency. I was tryi9ng to find commercial liability insurance for my new comp-any and BizInsure was easy to use and very affordable which is great for me as a new business. Every Home Health Care Provider, Home Health Aide, and Home Health Agency is unique, despite all working in the same industry. Insurers take into account a variety of factors to calculate your premiums—the amount you will regularly pay for your home health care insurance coverage. Give one of our agents a call to save money on your Business Insurance. Some of our Commercial insurance coverages include Bonds, Builders Risk, Business Owners Policy , Commercial Auto, and Commercial Property.

Our highly skilled and experienced agents are always available to help you get the best policies possible at very affordable rates. Customer satisfaction is of the utmost importance to us, and we pride ourselves on offering a top-notch experience from beginning to end. As our clients will attest, InsureMyRCFE is a clear leader among home care liability insurance companies. In our litigious society, more and more businesses are being sued due to issues like libel, slander, property damage, and bodily injury, just to name a few. Apart from that, businesses can be sued even when they have not done anything wrong.

A BOP bundles commercial property insurance and general liability coverage under one plan. It's often the most cost-effective type of commercial insurance for in-home care. In the interest of providing the most comprehensive coverage possible, CM&F’s home health care group malpractice insurance fluctuates with the relevant laws that dictate scope of practice. Should the scope of practice for the insured change, your policy automatically includes those changes, so you never have to worry about a gap in patient care services covered.

The liability insurance should cover any claims asserted against the HHA and the employee. Let’s say that, in providing services to the patient, the HHA nurse fails to adhere to the plan of care prepared by the treating physician, resulting in harm to the patient. The insurance should cover a claim asserted against the HHA and the nurse.

No comments:

Post a Comment