Table of Content

- InsureMyRCFE – Your Dependable Liability Insurance Company for Home Care

- Get an Instant Online Quote from The Hartford

- Miscellaneous Medical Liability Package for Home Health Care Provider

- Understanding Common Home Health Care Liabilities

- Professional & General Liability

- Insurance for Home Health Care Provider

- General Liability Insurance for Home Health Care Business

CM&F provides professional liability insurance for over 200 different healthcare professions, as well as healthcare groups and clinics. Gloves and masks should be worn at all times when working around any bodily fluids as these can transmit diseases. Cuts and puncture wounds may be caused by the use of sharp equipment such as scalpels or needles.

A civil Assistant U.S. Attorney will review the lawsuit and will conduct an investigation. If the civil AUSA concludes that the lawsuit has merit, then the DOJ will intervene (i.e., take the lawsuit over). At that time, the lawsuit will be “unsealed.” Even if the DOJ does not take the lawsuit over, the relator and his or her attorney can still proceed with the lawsuit. If the civil AUSA believes that the facts are egregious, then the civil AUSA will hand the file to a criminal AUSA who will determine whether or not to bring a separate criminal case against the HHA.

InsureMyRCFE – Your Dependable Liability Insurance Company for Home Care

They often have an auto risk with hired and non-owned insurance as well as employee dishonesty exposures. There is always a possibility that any professional’s work may fail to meet their clients’ expectations, resulting in a professional liability claim or lawsuit. Professional liability insurance is designed to protect the professional from the significant financial loss that can result from a lawsuit. General Liability coverage, also referred to as Commercial General Liability or “slip and fall coverage”, can protect your business against bodily injury or property damage lawsuits from outside parties. Professional Liability insurance can protect professional service providers from potentially devastating financial damages resulting from alleged negligence or error in the delivery of your services. If you get sued, this insurance can pay your legal costs, which includes the cost of an attorney and a settlement if one is awarded.

All CM&F home health care group professional liability insurance policies include Workplace liability insurance to provide coverage for claims of bodily injury or property damage brought by patients. Additional general liability coverage is available as an add-on in the application process. Hand-in-hand with general liability, professional liability insurance protects healthcare professionals from patient claims of negligence or malpractice, and protects your business from lawsuits filed against a staffed employee. This type of insurance is especially critical for anyone in the healthcare industry, as such claims against professional competence are not uncommon. Medical and DentalDiscover New York business insurance for medical and dental professionals.

Get an Instant Online Quote from The Hartford

Home healthcare professionals who offer medical care will pay more for insurance than non-medical caregivers. If a Home Care caregiver fails to recognize critical changes in the patient’s condition or general health, the result might be a medical crisis, adverse outcome or even a fatality for which the Home Care agency is held liable. The Professional Health Care Liability policy will cover such claims. The key words are bodily injury and property damage, defend and legally obligated. You may add additional insured to your group liability policy at anytime. This can be done during the application process, as well as throughout the lifetime of the policy.

Construction ContractorsLearn about New York construction contractors insurance, including how much the premium costs and what is covered - and how commercial insurance can help protect your NY construction business from lawsuits. AgribusinessLearn about NY agribusiness insurance - a type of commercial insurance protects farmers against loss of, or damage to crops or livestock. Get the best NY small business insurance quotes online & info on cost, coverage, minimum requirements, certificates & more. Post-Payment Audits—Like other health care providers, HHAs are targets of post-payment audits.

Miscellaneous Medical Liability Package for Home Health Care Provider

Errors and Omissions Insurance—This is sometimes known as director’s liability insurance. Malpractice Insurance—This is a form of liability insurance and is often included in liability insurance. While general liability insurance covers all manner of liability (e.g., causing an automobile accident), malpractice insurance is limited to clinical actions. If you have a personal umbrella liability policy, there's generally an exclusion for business-related liability.

Marine, Boat And WatercraftDiscover what types of commercial insurance government entities in New York need. Manufacturers face many unique risks such as product liability and/or product recall exposures due to the nature of their business operations. Local, State And Federal GovernmentDiscover what types of commercial insurance government entities in New York need. Third party payers (Medicare fee-for-service, Medicare Advantage, state Medicaid programs, Medicaid Managed Care and commercial insurers) are aggressively taking steps to contain costs. Click any of the following links to submit a quote for quick, accurate and affordable rates.

Understanding Common Home Health Care Liabilities

MiscellaneousFind informative articles on miscellaneous NY businesses including the types of commercial insurance they need, costs and other considerations. Health and BeautyLearn about New York health and beauty insurance coverages that help protect tattoo artists, salons, spas, estheticians, cosmetologists, barbers, hairdressers, nail salons and more from legal liability. Financial InstitutionsDiscover the types of commercial insurance that banks, finance companies and other New York financial institutions need to protect their asset management, deposit, lending, investment and other operations. Liability Insurance—This type of insurance covers the HHA for any negligent acts committed by an employee of the HHA.

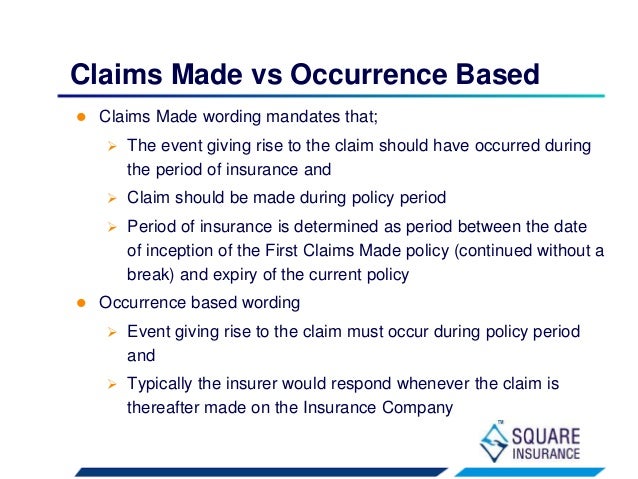

If your current policy is a claims-made policy, it is best to discuss the transition options with a CM&F service professional. We will help to ensure there are no gaps in your liability insurance coverage. Thimble is a new insurance alternative for small business owners who may only need general liability insurance coverage for a short period of time.

For example, one of your clients claims that an employee of your agency administered the incorrect medication at a recent visit. Your Professional Liability policy will help pay legal expenses incurred while defending your home health care business in court. Small Business Commercial AutoLearn about New York commercial auto insurance which includes liability and physical damage protection for vehicles that are used for business purposes. In a retail business, you need to have the right type of commercial insurance coverage so that your store, employees, and inventory are protected. Real EstateLearn about New York real estate insurance coverages including liability and commercial property policies for realtors, mortgage companies and more.

I would suggest him because he helped me find a affordable rate and explained all the technicalities.. Get your business covered with a comprehensive policy from BizInsure! We offer General Liability Insurance, Professional Liability Insurance, also known as Errors & Omissions insurance (E&O), Workers Compensation Insurance, and Business Owner’s Policy.

Our society in this time is facing an unprecedented demographic shift. Due to many factors, aging in home and telehealth services, The global home healthcare market is anticipated to reach $517B by 2027. Home health care is a wide range of health care services that can be given in your home for an illness or injury. Home health care is usually less expensive, more convenient and can, in some circumstances and with some patients be as effective as care you get in a hospital or skilled nursing facility . "We needed quotes fast and coverage even faster. We received both. We appreciate your service. THANK YOU." These insurance policies cover the most common risks of caregiving.

For example a roofer working on a roof faces much higher risks than an accountant sitting in an office behind a desk. Depending on the wording of the policy, this type of insurance may cover the defense and settlement of a whistleblower lawsuit. If the liability insurance policy is broad enough, it might cover acts as diverse as libel, slander and sexual harassment. The allegation will be that the HHA failed to act the way that a reasonable HHA would act under the same or similar circumstances, and that such failure resulted in the bad outcome. Defend – If the patient or consumer sues the Home Care agency for the negligence of its employed caregiver then the General Liability policy will provide an attorney and defend you in the lawsuit.

A common example is if an HHA employee is driving his or her automobile to a patient’s home and the employee causes an accident. The insurance should cover any claims, resulting from the accident, asserted against the HHA and against the employee. Property Damage – If a caregiver while at the patient or consumer’s house causes any property damage to the patient or consumer’s property, the General Liability policy will pay for that loss. Many Home Care and Home Health firms make the costly mistake of relying on General Liability policies to provide adequate coverage for potential claims. Without specialized coverage, you might be held responsible for defending and paying claims that could be catastrophic for your business.

Food and DrinkLearn about New York restaurants, bars, liquor stores commercial insurance coverages. See how food service insurance help protect against accidents, oversights and lawsuits resulting from business operations. If you have an occurrence policy, you can simply purchase the CM&F professional liability insurance policy when the policy with your current insurance provider expires. When using our online application, you are able to select your coverage date at least 30 days in advance, so you don't have to worry about coming back to apply on the exact day. Home health and assisted living facilities typically require specialized coverages for both general liability insurance and professional liability.

No comments:

Post a Comment